Over two years ago, an MIT research group ran a simulation of the low-Earth orbit broadband constellations of OneWeb, SpaceX, and Telesat, and last January they repeated the simulation updating with revised constellation characteristics and adding Amazon's Project Kuiper.

They ran the new simulation twice, once using the planned initial deployments of each constellation and a second time using the configuration shown below, which shows final deployments assuming that change requests that were pending in January would be approved. (SpaceX's have been approved). I will discuss the second simulation here and you can consult the paper for the results of the initial deployment simulation.

The following figure shows the total system throughput for each constellation as a function of the number of ground stations and whether or not the satellites have optical inter-satellite links (OISLs) enabling them to route traffic through the in-orbit grid. (The lines show averages and the shaded regions show interquartile values).

|

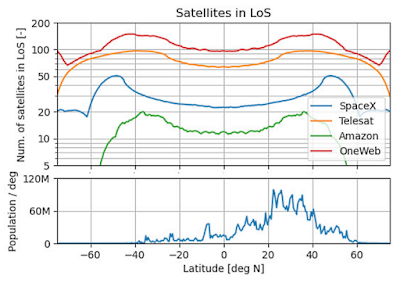

| Note that Telesat is committed to having OISLs in all their satellites and SpaceX will have them in their polar-orbit version 1.5 satellites that are launching this year and in all version 2 satellites starting next year. OneWeb initially planned to include OISLs but decided not to for now and Amazon has not committed to them but has formed an OISL hardware team. The following figure shows the number of satellites in line of sight (LoS) at full deployment and population as a function of latitude. All Amazon satellites are in inclined orbits, so, while major population centers are served, polar regions are not and the altitudes of the OneWeb and Telesat constellations increase the numbers of satellites in LoS. |

If interested, you should read this and the earlier paper (links in the opening paragraph) for details on the methodology, assumptions, and results, but I will conclude with a couple of caveats.

This simulation ignores the 7,518 very low-Earth orbit satellites that have been approved for SpaceX and the designs of all of the constellations are in flux. SpaceX will soon be launching version 1.5 satellites followed by version 2 next year. Similarly, OneWeb will be launching improved satellites by the time the constellation is complete and Telesat and Amazon are still in the design phase.

The simulation assumes that demand is proportional to population (based on a 0.1-degree resolution grid), so mobile utilization by ships, planes, and vehicles is not considered. It also assumes each individual consumes an average of 300 Kbps and the total addressable market is 10% of the global population. As they admit, the 10% is optimistic. (Elon Musk expects 3-5%). Since SpaceX will be charging the same price in every nation, their per-capita subscription rates will vary with national income, and the companies' target markets vary. For example, Telesat will not market to consumers.

While the specifics will change and this and other simulations will have to be rerun over time, this simulation considers key variables, and general conclusions can be drawn. For example, in this simulation, maximum throughput is from 13-42% higher when 20 Gbps OISLs are assumed. Currently, only SpaceX and Telesat are committed to OISLs, but since OISL technology is improving and they also improve latency, save on ground station cost and enable coverage at sea and other isolated locations, I expect all operators to eventually adopt them. (We may also see OISLs between layers, for example, between Telesat's LEO and GEO constellations).

No comments:

Post a Comment